Commentary on investing, January 2022

January 22, 2022Note: I am not an accredited investor and none of the following constitutes investment advice. SEC please don't hurt me.

tl;dr: Overall, I expect 2022 to be a repeat of 2001 in regards to U.S. equities, and 2018 in regards to crypto, while commodities will outperform the rest. Longer-term, equities performance will depend entirely on federal policy, and I suspect that will mean stagflation for the next decade. Crypto will probably have a shorter sleep than after 2017, and I expect BTC to recover from the current decline before 2024, but futures are again a concern for long-term health. Commodities will (definitionally) keep up with inflation, but don't expect stellar performance from any in particular besides gold and perhaps silver.

Gold: The Once and Future King

I love gold. Despite much malignment from conventional investors, I believe gold continues to be the investment par excellence for a twin reason: its value is derived independently of government policy, and yet governments continue to hoard it. Central bank reserves are the highest they've been since before the fall of the Soviet Union. I plan to write more about at length about gold in the future, but suffice to say that gold is the standard by which I measure all my other investments. If you've never seen gold in person or held it in your hand, I'd recommend doing so. It's no wonder it's been considered valuable by all peoples at all times literally since before written history.In terms of ways to invest in gold, I have three personal favorites and two I avoid:

- Old (primarily European) coinage: Very low premiums, yet fractional and with far better aesthetics than modern pieces. I'm a personal fan of 20 LMU francs and Austrian restrikes.

- Recent RCM and Royal Mint 1 oz coins and bars: The full ounce size keeps premiums low while offering worthwhile security features.

- Sprott Physical Gold Trust (PHYS): Although personally-holding gold is the only surefire way to eliminate counterparty risk, PHYS is the next-best thing. Unique advantages include no upfront premium (though at a cost of a 0.42% yearly expense ratio) and no risk of theft.

- iShares Gold Trust (IAU), Invesco DB Gold Fund (DGL), and other derivatives-based gold funds: Their gold literally does not exist. They own promises to gold, but if gold ever becomes scarce, those promises will go up in smoke, and their prospectives admit to as much in the risk sections.

- American gold coins: Although easily the most aesthetically pleasing choice, with high demand comes a high price, with premiums nearly double that of the old coins mentioned earlier.

- I also just generally avoid anything with a high premium. If you want to get started in numismatics and coin collecting, don't let me stop you, however you must recognize at that point you are no longer investing, you are participating in a costly hobby.

Silver: A Once and Future Prince?

There's been a lot of hype about silver online recently, and not without good reason. Strategic silver reserves are dwindling, demand is expected to increase due to use in renewable energy products, and conspicuous rumblings have led to a lot of interest from amateur and professional investors alike. I think it's generally all good intel and that the market as a whole isn't paying attention because it hasn't had to in over forty years. In terms of what I'm buying, it's generally the same story as with gold: low-premium physical and the Sprott Physical Silver Trust (PSLV). The advantages to buying PSLV are even greater than that with PHYS, as the upfront premiums for physical silver tend to be over three times that than with gold.All that said, silver merely remains poised for a correction, and will probably continue its gradual shift from monetary into industrial metal as time moves forward. I do not anticipate that I will still have substantial silver exposure a decade from now.

General Commodities

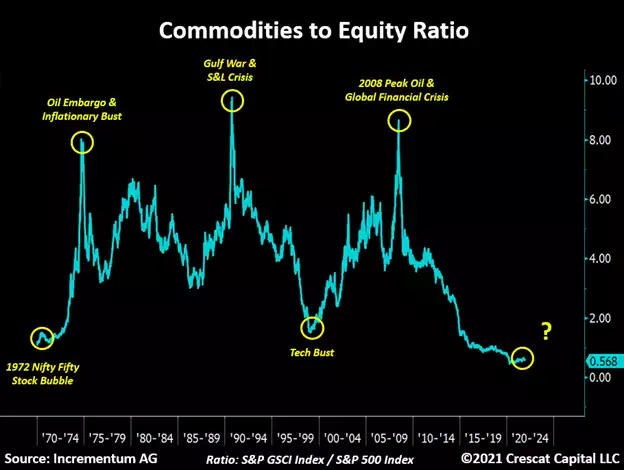

I believe that, despite the rally over the past year, commodities remain undervalued, especially in relation to traditional equities. The following graph (courtesy of Crescat Capital) really says everything you need to know.

For broad commodity exposure, I am currently invested in Invesco Optimum Yield Diversified Commodity Strategy ETF (PDBC) due to its higher historical returns compared to other commodity funds.

Mining Stocks

Given my bullish views on precious metals and commodities, it follows that I would also invest in producers of those goods. Indeed, while I will decline name individual companies (you'll have to do your own research on this one), suffice to say that I am focused on tiny gold and especially silver miners for maximum returns. Good ETFs for this are the VanEck Junior Gold Miners ETF (GDXJ) (and its leveraged equivalent, JNUG) and the ETFMG Prime Junior Silver Miners ETF (SILJ) (and its leveraged equivalent, SILX). One caveat to those funds, however, is that they tend to exclude the tiniest companies, thereby limiting potential returns somewhat compared to picking those tinier miners out.Due to the simultaneously lower hypothetical returns and fewer methods of managing risk (there are no effectively no farming ETFs) I am not invested in non-precious metal producers.

Oil (and Producers)

Oil is pretty much entirely at the mercy of OPEC and domestic regulators. There's money to be made here, but the headache resulting from essentially random swings isn't worth it to me. As a sector its probably institutionally undervalued due to ESG restrictions.Uranium

Despite a roughly 100% increase in the price of the Global X Uranium ETF (URA) and other sector funds since 2020, I believe uranium as a sector remains undervalued. Carbon fuels are an on increasingly thin ground, and the world is still decades off from scalable solar or fusion technology. This leaves one viable option for meeting mid-term energy requirements: uranium-based fission reactors. Capital flow into the sector will naturally result in what should prove to be very good returns. A classic value investment.Bitcoin (and Altcoins)

As of writing, Bitcoin is in the middle of a downward spiral, which I expect will continue until eventually settling in the range of $20,000 over the coming months, at which point I plan to begin accumulating Bitcoin and Ethereum long-term.Much like was the case in 2018, I expect altcoins to follow Bitcoin's lead, with the weaker ones fading away.

One long-term challenge Bitcoin faces is the recent introduction of a professional Bitcoin futures fund. As is the case with all non-consumable products, futures create artificial supply, thereby satiating demand and thus suppressing the pricer lower than what it would be naturally. Bitcoin maximalists love to toute the 21 million cap on Bitcoin, but that will hardly matter if there's a billion coins' worth of perpetual futures contracts being treated as good as BTC floating around out there. (Now where have I heard that before?)

Monero

Others have already made the case for Monero compared to other crypto, so I won't belabour the point. Suffice to say that Monero is easily the most undervalued cryptocurrency project, because it's the only cryptocurrency that's actually used for anything other than interacting with other cryptocurrencies. Monero is my only current crypto holding, I do not plan on selling it, and will continue buying it more aggressively than either Bitcoin or Ethereum.China

The real estate situation in China is worse than you have been led to believe. There is now effectively zero demand for property development in a country where property development has historically represented a third of their economy. I think it would be an understatement to say that this will have negative economic consequences. As such, I have been swing trading YANG.Real Estate

There appears to be a general perception that real estate is in another 2008-style bubble. I do not believe this is the case, for the simple fact that there's a general shortage of housing. Shortages of an inelastic good are not conditions conducive to a decrease in price.[citation needed] Indeed, it's my belief that it's this shortage, combined with the massive debt monetization, that has caused the price of housing to surge in the past two years. Although I predict a mild decline in home prices as the result of an impending recession, I wouldn't strongly factor it into any calculations.That said, there may be a shorting opportunity available with retail and office space REITs, given that I believe the business models of their tenants have been given a death blow by Covid and will prove to be unsustainable. People were predicting the death of retail in the 2010's, and I think the double-whammy of Covid and a recession will prove to be what dug its grave.

Additionally, I currently hold the Gladstone Land Corporation (LAND) in my IRA. Their business model is essentially to buy farmland and lease it out to farmers. The long-term value of owning a fixed asset necessary to grow food should be obvious.

S&P 500 / SPY

I am generally not a fan of index funds (article forthcoming, I will allow Michael Burry and Peter Lynch to speak for me). That said, there are better and worse indices. The megacaps in the Nasdaq-100 make it alluring for growth. The Russell 2000 offers broad market exposure. Various international indices offer obvious hedging benefits compared to domestic funds.And then there's the S&P 500.

I'm honestly not sure who the S&P 500 is supposed to appeal to. Its top spots have some quality companies, yes, but frankly, most of the rest are overhyped crap that will crash and burn the second money dries up. I'm talking about companies like Chipotle, Etsy, Intuit, Salesforce, Disney and other companies (all of which have a PE over 40) that are only in the index because of media hype. One of the components literally just sells air in bags. Yes, there's rising stars in there (tip: they're also in the Russell 2000), but I'd argue there's just as many fading stars to accompany them.

That said, if I was forced to buy the S&P 500 for whatever reason, I would definitely go with Schwab's SWSPX over the vastly more popular SPDR SPY for the simple reason that the expense ratio is four-and-a-half times lower.

TQQQ + SQQQ: A Match Made in Heaven

There's an old saying in stocks, "time in the market beats timing the market." I intend to prove this saying wrong. Although one can obviously never time the market perfectly, I believe I have enough insight to generate massive alpha via the funds TQQQ (triple leveraged Nasdaq-100) and SQQQ (triple inverse leveraged Nasdaq-100).Now, the following assumes some honest assessments on my part, but I've tried to be conservative in my calculations to return as little of a return as possible.

Let's assume I invested $10,000 into triple-leveraged Nasdaq-1000 on January 1, 1994. I would have started becoming concerned with a bubble popping around the turn of the millenium with the index around $3,500. Cashing out my leveraged fund at that point would have netted me $670,000. Then let's say I re-entered with a triple-leveraged short position after it shed 30% off its all-time high around five months later and held that until it had shown a year of steady gains and reasonable PE ratio in late 2003. I'm now sitting on $3 million. Two trades and less than one decade has turned fairly mild starting capital into enough to retire on, which is likely what I'd do.

But let's say I'm greedy and three mil isn't enough. So, I flip it back into triple-leveraged QQQ. Three years later in 2007, I'm sitting on $10 million, convinced nothing can stop me. Unfortunately, my irrational exhuberance has blinded me, and I do not see the impending housing market crash. I write it off at first (PE is still reasonable after all), but I've been paying attention to trends and when the market crashes on September 29, 2008, I pull out, with $1.5 million left. I decide not to go short, however, as while Wall Street is a bloodbath, the Fed indicates an easy money policy, and PE ratios remain somewhat reasonable, so I hold onto bonds for the time being.

It's New Years 2010, and I've decided to re-enter the market. The Nasdaq has essentially recovered to its pre-crash levels, and PE is right at 20. It's somewhat rough going at first, but then the ball really gets rolling. By 2015 I'm back up to $10 million. By 2020 I'm sitting on nearly $50 million and the economy is still chugging along fine. Then 'rona happens and I probably lose all my money by opening ill-timed shorts but I think by now you get my point that combining even somewhat decent timing with triple-leveraged funds have incredible potential.

Anyway that's all to say that I currently have a position in SQQQ that I plan to flip into TQQQ around 18 months from now hopefully, then retire as a millionaire in a decade or so.

VT: The One True Index Fund

All that said about index funds, there is one I plan to invest in if I ever do acquire enough money to live off of: the Vanguard Total World Stock ETF (VT). It covers effectively all relevant stocks on the entire planet. No worries about some sort of geostrategic shenanigans, or a secular decline in American equities, or any of those long-term concerns. If the global economy is gaining value (which it has been for the past millenia or so), VT is gaining value. And if that thousand-year trend reverses, my friend I have a lot more to worry about than my stock portfolio.VIX and Other Volatility Products

I was holding VIXM and trading UVXY options for a while but more recently exited those positions as it is looking increasingly likely that the market will face a more gradual burnoff and not the blowoff that would give volatility investors massive returns they're looking for.Bonds

Garbage. Young people getting tricked by the "60/40" rule are essentially getting scammed given the negative real yield everything but junk bonds are giving. The only bonds I own are when I need to park money, in which case I buy a TIPS ETF.On a longer timescale, I think bonds (and interest rates in general) will continue to be persistently low. As much as central banks might want to try to raise rates in order to curb inflation, the fact is that most of the historical bulk of interest has been in risk uncertainty; that is to say, a medieval banker could hardly tell the difference between a worthy creditor and a scam artist. Modern risk management tools like credit scores and streamlined repo processes have essentially eliminated risk analysis as a factor. As such, I expect that, for example, prime mortgages will, perhaps barring occasional exceptions, never return to what they were circa 2009. All central bank attempts to raise rates will do is dry up liquidity.